Our PurposeHulett Capital seeks to partner with family and founder-owned industrial services businesses to unlock the growth potential of your business by providing long-term capital, strategic support, and thoughtful transition solutions. Attractive situations include opportunities to: broaden a distribution channel or operational focus, expand a company’s intellectual property portfolio, build out a sales and marketing team, supplement the management team with strategic leadership or scale a business through strategic add-on acquisitions. We focus on companies operating in critical service markets that support infrastructure, facilities, and regulated end markets across North America. Our Investment CriteriaBusiness Characteristics We Seek

|

Why Partner With Hulett Capital

Deep Sector Insight

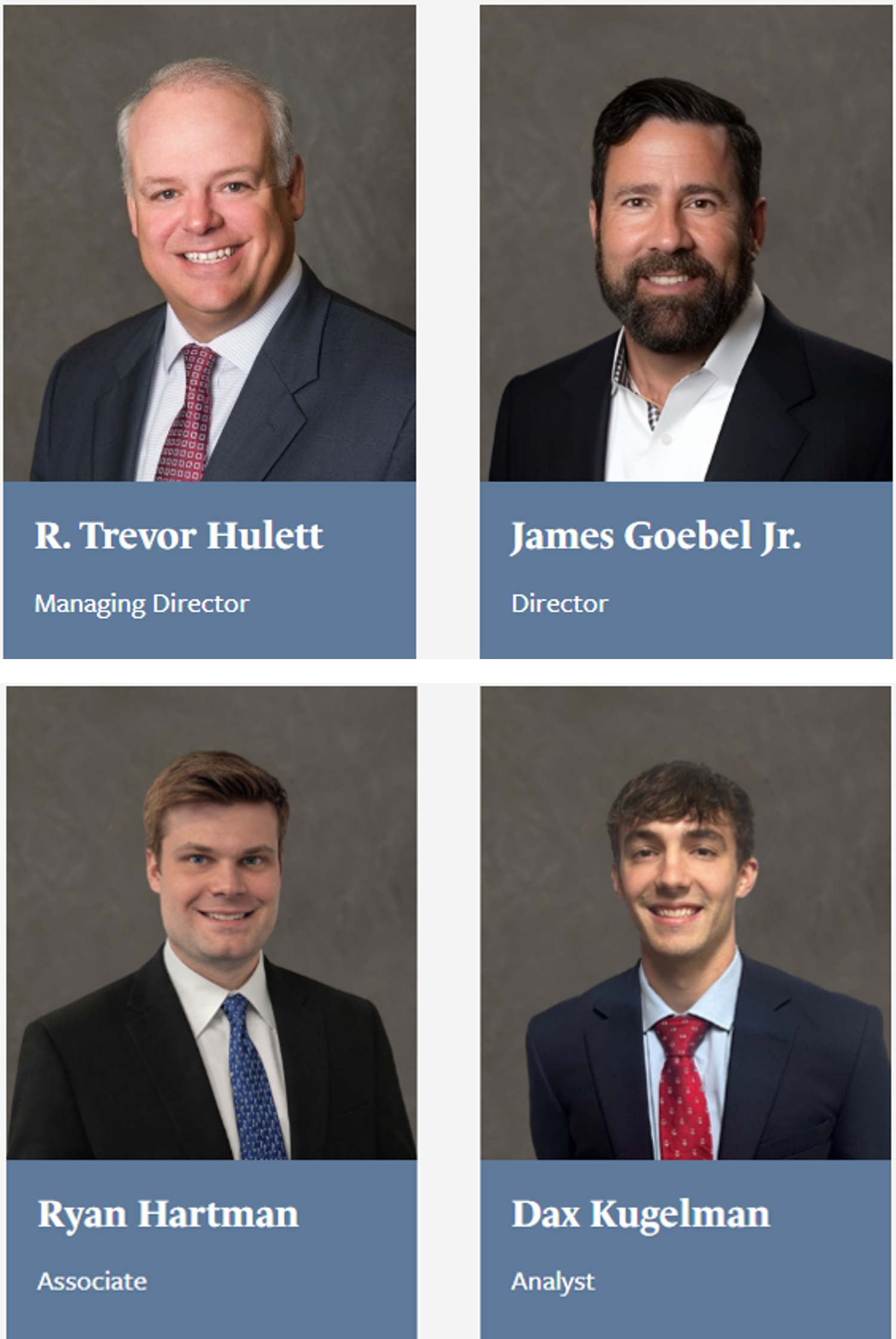

Our sponsor team is affiliated with R.L. Hulett, a middle-market investment bank with a 45 year history of advising family and founder owned businesses across industrial services and related sectors. R.L. Hulett’s experience advising industrial and service-oriented clients gives Hulett Capital unique insight into the operational dynamics, valuation drivers, and strategic opportunities in these markets. RL Hulett

Founder-Friendly, Value-Driven Approach

As a second generation family business, we understand the complexities of transitioning the business you’ve built to new ownership. Our approach is built on respect for legacy, continuity for employees and customers, and proactive investment to improve operations, capabilities, and market reach.

Flexible Capital Solutions

Unlike traditional private equity, Hulett Capital operates as an independent sponsor, offering tailored ownership structures and capital solutions that align with owner goals, including:

-

Structured buyouts

-

Majority recapitalizations

-

Management-led succession solutions

-

Strategic add-on acquisition support